Signalia's Take On

Oct 10, 2025

Q3 2025 Global Hotel Guest Experience Benchmark: Key Insights on Reputation, Satisfaction, and Service

The latest Shiji-ReviewPro Q3 2025 Guest Experience Benchmark provides a comprehensive look at the evolving landscape of guest satisfaction and hotel reputation based on analysis of 11.5 million guest reviews and 34 million mentions across 11,200 hotels globally.

Spanning seven major regions and across 3-, 4-, and 5-star hotels, the insights reveal important trends for hoteliers seeking to optimize guest experience, manage online reputation, and respond effectively to feedback.

Global Reputation and Review Volume Trends

The Global Review Index (GRI), the industry-standard reputation score derived by ReviewPro, showed an overall positive momentum in Q3 2025 compared to the same period in 2024. With the GRI rising across all star categories and key regions, hotels are seeing increased guest satisfaction levels supported by higher review volumes. Notably, the merging of Hotels.com reviews into Expedia’s dataset has refined market share visibility among Online Travel Agencies (OTAs), guiding hotels on where guest feedback is most influential.

Review volume increased by 2.6 percentage points globally, with significant growth in regions like Asia and Latin America. Meanwhile, average response times to online reviews improved marginally, with 5-star hotels maintaining the fastest average response time of around 2.5 days. However, the percentage of reviews responded to varies by hotel category, underscoring a need to prioritize engagement especially for mid-tier hotels.

Key Drivers of Guest Satisfaction and Reputation Impact

Analysis of departmental scores revealed that service quality, particularly staff experience, remains the most positively influential factor on guest reviews, with service ratings positively affecting the GRI across all hotel classes. Conversely, areas like cleanliness, room quality, and food and beverage have exhibited slight declines in satisfaction scores, presenting opportunities for targeted operational improvements.

For 3-star hotels, establishment and cleanliness had the strongest negative impact on reputation, while for 5-star hotels, room condition and food and drinks were crucial pain points impacting scores. These nuances highlight the importance of segmenting feedback to address specific guest expectations by hotel category.

Regional Variations and Guest Type Insights

The report breaks down performance metrics by region, revealing diverse guest experience dynamics. North America and Asia lead in GRI scores, while regions like Africa and Latin America demonstrate more fluctuations, often linked to infrastructure and service consistency challenges.

Guest types—such as couples, families, solo travelers, groups, and business travelers—also influence satisfaction trends. Business travelers generally report higher satisfaction, while family and group segments show more variability influenced by amenities and value perception.

Survey Response Behaviors and Engagement

One standout focus area is guest engagement through post-stay and in-stay surveys. The survey completion rates and average times indicate rising guest willingness to provide feedback, yet survey abandonment remains a concern in certain regions. On average, surveys are completed in under 10 minutes, reflecting growing guest readiness to share experiences when surveys are optimized for ease and relevance.

Hotels that actively manage survey engagement and leverage rapid response strategies tend to maintain higher reputation scores and enhanced guest loyalty.

Strategic Takeaways for Hoteliers

Prioritize staff training and guest service excellence: Service remains the top driver of positive reviews and overall reputation—investing in staff empowers guest satisfaction significantly.

Focus on cleanliness and room condition recovery: These continue to be critical touchpoints, especially for mid- and high-tier hotels, to recover any negative perception.

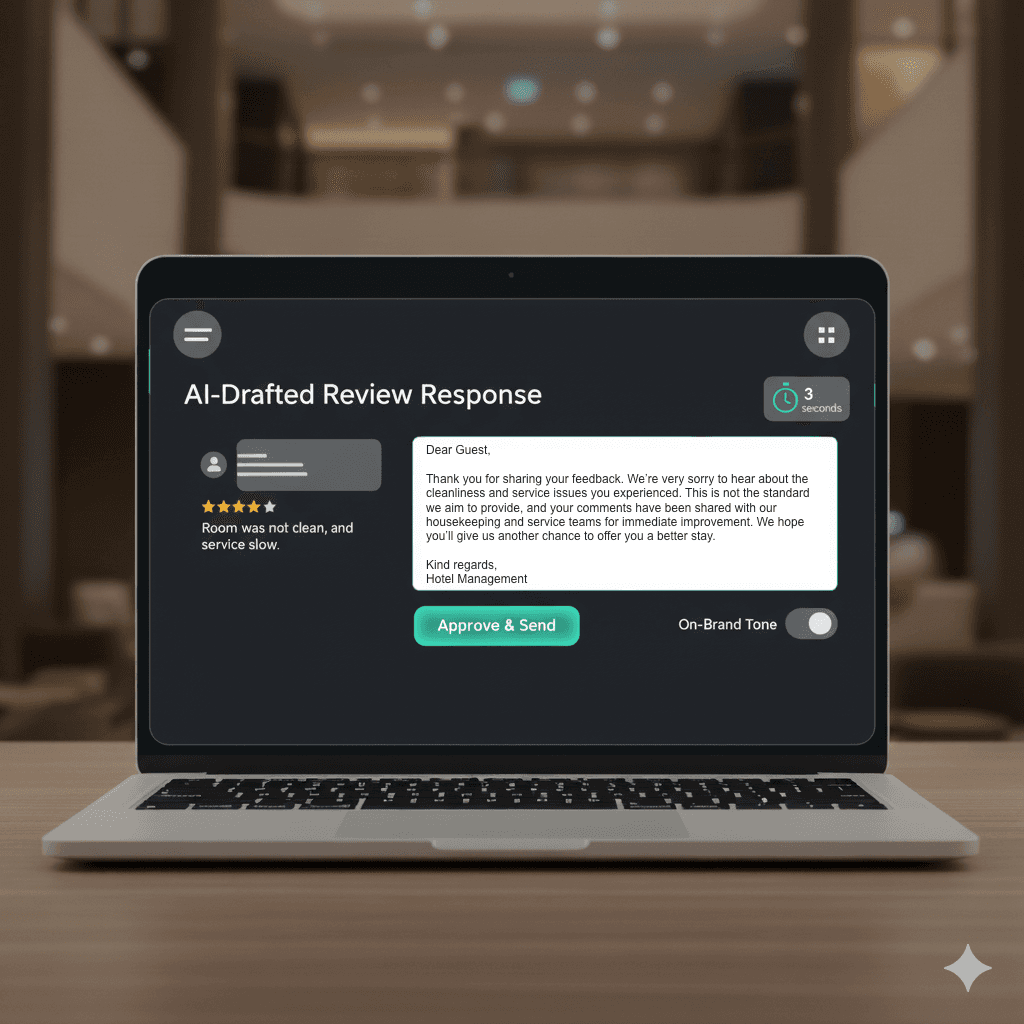

Optimize review response workflows: Timely and consistent reply to guest reviews is key to reputation resilience.

Tailor experience by guest segment and region: Understanding demographic and regional satisfaction differences enables precision improvements and targeted communication.

Enhance survey design and outreach: Streamlining surveys for faster completion and reducing drop-offs can increase valuable guest insights.

In a competitive lodging market, the Q3 2025 data underscores that meticulous reputation management backed by real-time guest feedback analytics remains essential for sustaining growth and building lasting guest trust.

This post encapsulates the report's global and regional findings, hotel category nuances, guest feedback trends, and actionable insights for the hospitality industry to enhance guest experience and online reputation management in the third quarter of 2025.